AI Tools to Detect Financial Fraud

In today's financial world, fraud evolves, requiring advanced and proactive solutions. Hudson Data uses AI & ML in Centurion to boost payment integrity, fight fraud effectively, and ensure data privacy.

Introduction

In today's financial landscape, the threat of fraud continues to evolve, requiring advanced and proactive solutions. At Hudson Data, we leverage Artificial Intelligence (AI) and Machine Learning (ML) within our Centurion platform to enhance payment integrity and combat financial fraud effectively. This article explores our specialized AI tools and strategies that enable real-time and historical fraud detection, while maintaining strict data privacy and compliance standards.

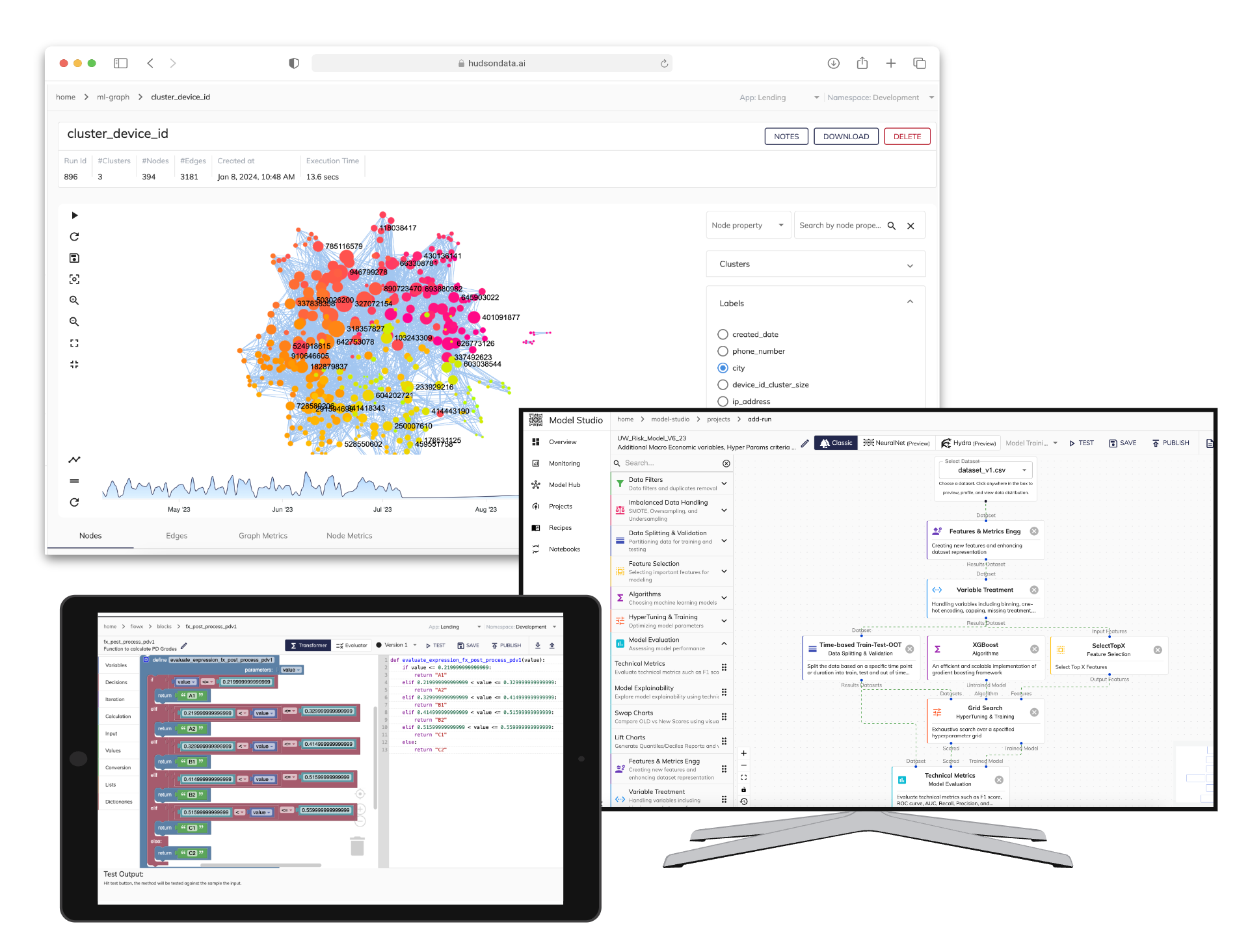

Centurion Platform: AI-Powered Fraud Detection

The Centurion platform combines cutting-edge modules, each designed to target specific aspects of fraud detection and prevention. Key features include:

Model Foundry

- AI/ML Model Development and Configuration: A centralized hub for developing, testing, and deploying AI/ML models tailored for fraud detection.

- Continuous Model Monitoring: Automated monitoring of model performance, ensuring they remain accurate and relevant over time.

Generative Rules Mining AI

- Automated Rule Generation: Uses generative AI to automatically create detection rules based on historical and real-time fraud patterns.

- Adaptive Learning: Continuously learns from new fraud incidents to refine and expand the rule base.

Temporal and Network Analysis Modules

- Temporal Analysis: Detects temporal anomalies by analyzing patterns in historical transaction data.

- Network Analysis: Identifies fraud networks through linkage and graph analytics, utilizing our ML-Graph product.

Flow-X Streaming Engine

- Real-Time Fraud Detection: Patented memory-aware streaming engine capable of processing billions of transactions in real time.

- Dynamic Alerts: Generates fraud alerts for immediate investigation and response.

Mitigating AI-Related Biases

To ensure fairness and compliance, we adhere to the SR-11-7 model risk management framework. Key practices include:

- Rigorous Testing and Validation: Statistical validation, third-party assessments, and continuous model monitoring.

- Fair Credit Reporting Act (FCRA) Compliance: Ensuring models comply with FCRA regulations through transparent and fair practices.

- Separation of Duties: Strict segregation of roles throughout the model lifecycle to prevent bias.

Addressing Fraud Patterns: Known-Knowns and Known-Unknowns

Known-Knowns

- Well-Defined Fraud Patterns: Leveraging historical data and established rules to detect familiar forms of fraud.

- Automated Detection Rules: Rules generated by the Generative Rules Mining AI target common fraud scenarios.

Known-Unknowns

- Supervised AI Mechanisms: Analyzing incidents where the exact nature of fraud was previously unidentified.

- Adaptive Learning Models: Continuously updating models based on new fraud instances to improve detection.

Towards Managing Unknown-Unknowns

Our ambition is to manage "Unknown-Unknowns," entirely novel forms of fraud, by:

- Unsupervised and Generative AI Techniques: Monitoring real-time data to uncover subtle anomalies indicative of new fraud patterns.

- Integrated Intelligence Sharing: Facilitating dynamic and secure sharing of insights across the financial industry.

Ensuring Data Protection and Compliance

Data Privacy and Security

Due to the sensitive nature of financial data, we prioritize data protection and compliance by:

- Global Data Protection Regulations: Complying with GDPR, CCPA, and industry guidelines like PCI-DSS.

- Data Minimization and Anonymization: Processing only necessary data and applying anonymization/pseudonymization techniques.

- Robust Encryption and Access Controls: Implementing encryption, access controls, and authentication mechanisms.

Secure Development Practices

- Privacy Impact Assessments: Integrated into the AI development lifecycle to prioritize security from inception.

- Vendor Risk Assessments: Ensuring third-party vendors adhere to data protection standards.

- Proactive Monitoring and Response Plans: Regular monitoring, incident response, and employee training.

Continuous Improvement and Compliance

- Ongoing Evaluation: Assessing and improving data protection measures to address evolving threats and regulatory changes.

Conclusion

Hudson Data's Centurion platform leverages the power of AI and ML to detect and prevent financial fraud efficiently. By adhering to strict data privacy standards and compliance regulations, we ensure our solutions not only protect financial institutions from fraud but also uphold the highest levels of customer trust. Our innovative AI tools, combined with proactive data sharing and a commitment to privacy, offer a comprehensive defense against today's ever-evolving financial fraud landscape.