Leveraging Hudson's Centurion: A Paradigm Shift in Combating First Party Fraud

Insurance industry battles first-party fraud. Hudson Data's Centurion offers AI-driven solutions for detection and prevention, revolutionizing fraud defense.

Introduction

The insurance industry has long been plagued by the insidious threat of fraud, with first party fraud emerging as a particularly complex and challenging phenomenon. Unlike traditional forms of fraud perpetrated by external actors, first party fraud occurs when policyholders themselves engage in deceptive practices, such as misrepresenting information or staging incidents to unlawfully claim benefits. This type of fraud is especially pernicious due to its covert nature, as fraudsters often operate under the guise of legitimacy, exploiting the inherent trust established within the insurer-policyholder relationship.

Conventional fraud detection measures, centered around Know Your Customer (KYC) and Know Your Business (KYB) protocols, have proven inadequate in addressing the intricacies of first party fraud. These frameworks, while crucial for verifying identities and establishing initial customer relationships, lack the continuous monitoring capabilities necessary to detect the subtle patterns and behavioral anomalies that often characterize first party fraud schemes.

In response to this pressing challenge, Hudson Data has developed Centurion, a groundbreaking AI-driven platform that promises to revolutionize the way the insurance industry approaches fraud detection and prevention.

The Nuanced Landscape of First Party Fraud

To fully appreciate the significance of Centurion's capabilities, it is essential to understand the complexities inherent in first party fraud. Unlike traditional fraud schemes perpetrated by external actors, first party fraud involves deception by individuals who have legitimately obtained insurance policies. This deception can manifest in various forms, including:

- Misrepresentation of Information: Policyholders may intentionally provide false or incomplete information during the application process or subsequent updates, with the intent of securing lower premiums or gaining coverage for pre-existing conditions.

- Staged Incidents: In some cases, policyholders may deliberately stage accidents, thefts, or other insured events to file fraudulent claims and obtain payouts.

- Exaggerated Claims: Even in the case of genuine incidents, policyholders may inflate the extent of damages or losses to receive larger compensation amounts.

- Collusion and Organized Fraud Rings: In more sophisticated scenarios, policyholders may collude with third parties, such as repair shops or medical providers, to inflate costs or submit fictitious claims.

The subtlety and diversity of these fraud tactics make them challenging to detect through conventional means. Fraudsters often exhibit an initial period of legitimate behavior, making it difficult to distinguish them from genuine policyholders based solely on identity verification or initial screening processes.

The Centurion Platform: A Multifaceted Approach to Fraud Detection

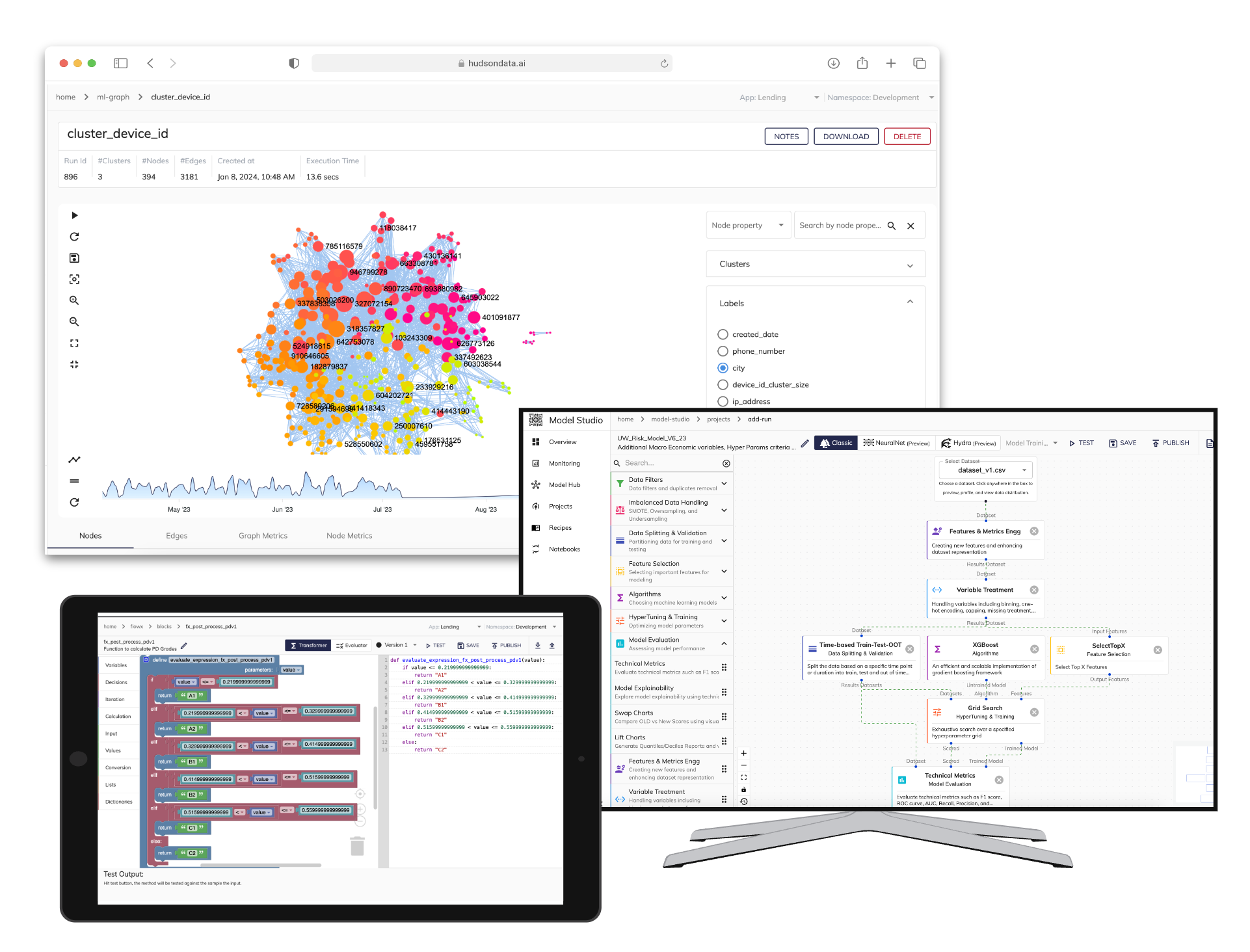

Hudson Data's Centurion platform represents a paradigm shift in the way insurers approach fraud detection, leveraging cutting-edge AI technologies to provide a comprehensive and dynamic solution. At its core, Centurion employs a multifaceted approach that spans data integration, predictive analytics, natural language processing, and behavioral analytics.

- Enhanced Data Integration: Unlike traditional fraud detection systems that rely on siloed data sources, Centurion seamlessly integrates a vast array of data streams, including real-time transactional data, customer interactions, external databases, and other relevant sources. This holistic data integration provides a 360-degree view of a policyholder's activities, enabling the platform to identify patterns and anomalies that might otherwise go unnoticed.

- Predictive Analytics and Machine Learning: At the heart of Centurion lies a sophisticated predictive analytics engine powered by advanced machine learning algorithms. These algorithms continuously analyze the integrated data streams, identifying patterns and anomalies that may indicate fraudulent behavior. Importantly, the platform's machine learning capabilities enable it to refine its predictive models over time, continuously improving its accuracy and responsiveness as new data emerges.

- Natural Language Processing (NLP): Centurion leverages the power of natural language processing to scrutinize written communications and claim submissions. By analyzing language patterns, emotional cues, and contextual clues, the platform can detect potential red flags that may be indicative of fraudulent intentions or deception. This capability enables Centurion to go beyond the surface-level analysis of data fields, providing a deeper understanding of the underlying context and motivations.

- Behavioral Analytics: One of the key differentiators of Centurion is its ability to monitor and analyze ongoing behavioral patterns rather than relying solely on static snapshots. By continuously tracking policyholder activities, such as claims history, premium payment patterns, and other relevant interactions, the platform can identify deviations from normal behavior that may signal potential fraud. This proactive approach enables insurers to detect and mitigate fraud attempts at an early stage, before significant losses occur.

Real-World Impact and Case Studies

The effectiveness of Centurion's capabilities has been demonstrated through several real-world applications and case studies. One notable example involved a sophisticated fraud ring operating across multiple states. By correlating data points from various sources, including transactional records, social media activity, and third-party databases, Centurion was able to identify a pattern of staged accidents and inflated repair costs. This breakthrough led to the dismantling of the fraud ring and the recovery of substantial amounts of fraudulently obtained funds.

In another case, Centurion's natural language processing capabilities proved invaluable in detecting a policyholder's attempts to exaggerate the extent of a claimed loss. By analyzing the language used in the claim submission and subsequent correspondence, the platform identified inconsistencies and emotional cues that suggested deception. This early detection allowed investigators to thoroughly review the case and ultimately prevent the payment of an illegitimate claim.

These examples illustrate the power of Centurion's multifaceted approach and its ability to uncover complex fraud schemes that might have evaded detection by traditional systems relying solely on rules-based or manual review processes.

Addressing Implementation Challenges

While the benefits of Centurion's AI-driven fraud detection capabilities are clear, integrating such an advanced platform into existing insurance operations poses several challenges that must be carefully addressed:

- Technical Integration: Insurers often rely on legacy systems and processes that may not seamlessly integrate with cutting-edge AI technologies like Centurion. Overcoming these technical hurdles requires careful planning, data mapping, and the development of robust APIs and interfaces to ensure seamless data exchange and interoperability.

- Data Privacy and Governance: The vast amount of data processed by Centurion, including sensitive personal and financial information, necessitates stringent data privacy and governance measures. Insurers must ensure compliance with relevant regulations, such as the General Data Protection Regulation (GDPR) and other industry-specific guidelines, while maintaining the integrity and security of the data.

- Continuous Model Training and Adaptation: The ever-evolving nature of fraud tactics demands that Centurion's machine learning models be continuously trained and refined to adapt to new patterns and strategies. This requires a dedicated team of data scientists and fraud analysts to monitor model performance, identify areas for improvement, and integrate new data sources as needed.

- Cultural Adoption and Change Management: Introducing advanced AI technologies like Centurion into an organization often requires a significant cultural shift, as employees must adapt to new processes and ways of working. Effective change management strategies, including comprehensive training and communication, are crucial to ensure a smooth transition and maximize the platform's benefits.

Hudson Data recognizes these challenges and has dedicated substantial resources to address them, ensuring that Centurion can be seamlessly integrated into existing insurance operations while adhering to the highest standards of data privacy, governance, and ethical compliance.

Future Directions and Enhancements

While Centurion already represents a significant leap forward in fraud detection capabilities, Hudson Data remains committed to continuously enhancing and expanding the platform's capabilities. Some of the key areas of focus for future developments include:

- Advanced Machine Learning Algorithms: As the field of machine learning continues to rapidly evolve, Hudson Data's research and development teams are actively exploring the integration of cutting-edge algorithms and techniques into Centurion. These advancements will further enhance the platform's predictive accuracy, enabling it to detect even the most subtle and sophisticated fraud patterns.

- Expanded Coverage of Fraud Types: While Centurion's current focus is on first party fraud, the platform's modular architecture allows for seamless expansion into other fraud domains, such as third-party fraud, cyber fraud, and emerging threats. By continuously monitoring industry trends and collaborating with insurers, Hudson Data aims to stay ahead of evolving fraud tactics.

- Intuitive User Interfaces: To facilitate better collaboration between human analysts and the AI system, Hudson Data is investing in enhancing Centurion's user interfaces. The goal is to create intuitive and visually compelling dashboards and tools that enable fraud investigators to seamlessly interact with the platform, interpret its insights, and leverage its capabilities to make informed decisions.

- Increased Automation and Streamlined Workflows: While human expertise remains essential in fraud investigation and decision-making, Hudson Data recognizes the potential for increased automation and streamlined workflows. Future enhancements to Centurion will focus on automating routine tasks, such as data ingestion, preprocessing, and initial triage, freeing up valuable human resources to focus on more complex analyses and decision-making processes.

The Road Ahead: Centurion's Role in Shaping the Future of Insurance Fraud Prevention

The introduction of Centurion marks a significant milestone in the insurance industry's ongoing battle against fraud. However, its impact extends far beyond the immediate realm of first party fraud detection. By demonstrating the transformative potential of AI-driven solutions, Centurion is paving the way for a broader paradigm shift in how insurers approach risk management, customer engagement, and operational efficiency.

- Reinforcing Trust and Transparency: One of the most significant benefits of Centurion lies in its ability to reinforce trust and transparency within the insurance ecosystem. By proactively identifying and mitigating fraud, the platform helps to protect the interests of honest policyholders and ensures that claim payouts are distributed fairly and accurately. This, in turn, fosters a more transparent and equitable insurance market, benefiting both insurers and customers.

- Enhancing Customer Experience: Centurion's advanced fraud detection capabilities can also contribute to improving the overall customer experience. By streamlining claim processes and reducing the need for extensive manual reviews, legitimate policyholders can expect faster and more efficient claims processing. Additionally, the platform's continuous monitoring capabilities can identify potential areas of improvement in customer interactions, enabling insurers to proactively address pain points and deliver a superior experience.

- Driving Operational Efficiencies: Beyond fraud detection, the insights and data integration capabilities of Centurion can be leveraged to optimize various aspects of an insurer's operations. For instance, the platform's predictive analytics and behavioral modeling could inform more accurate risk assessments, pricing strategies, and resource allocation decisions. This holistic approach to data-driven decision-making has the potential to drive significant cost savings and operational efficiencies across the entire insurance value chain.

- Enabling Collaborative Efforts: The complexity and ever-evolving nature of fraud tactics necessitate a collaborative approach among insurers, regulators, and technology providers. Centurion's modular architecture and open APIs facilitate seamless data sharing and integration with other systems, enabling insurers to participate in industry-wide efforts to combat fraud while adhering to data privacy and security standards.

- Advancing AI Governance and Ethics: As AI technologies continue to gain traction in various industries, there is a growing need for robust governance frameworks and ethical guidelines. Hudson Data's development of Centurion has been guided by a strong commitment to ethical AI practices, ensuring transparency, fairness, and accountability in the platform's decision-making processes. This approach positions the company as a leader in responsible AI adoption, contributing to the advancement of industry-wide best practices and standards.

Conclusion: A Paradigm Shift in Fraud Prevention and Beyond

Hudson Data's Centurion platform represents a transformative leap in the insurance industry's approach to fraud detection and prevention. By harnessing the power of advanced AI technologies, including machine learning, natural language processing, and behavioral analytics, Centurion provides a comprehensive and dynamic solution to combat the complex challenges posed by first party fraud.

However, Centurion's impact extends far beyond its immediate application in fraud detection. By demonstrating the transformative potential of AI-driven solutions, the platform is paving the way for a broader paradigm shift in how insurers approach risk management, customer engagement, and operational efficiency.

As the insurance industry continues to evolve and face new challenges, solutions like Centurion will play a pivotal role in enabling insurers to stay ahead of emerging threats while delivering superior customer experiences and driving operational efficiencies.