Solutions to Prevent First Party Financial Fraud

Introduction

In the rapidly advancing domain of financial services, combating systematic financial fraud is more crucial than ever. At Hudson Data, we specialize in identifying and neutralizing such threats through our Centurion SaaS Platform. This award-winning solution is distinguished by its innovative approach to safeguarding against financial fraud and improper payments, leveraging our patented memory-aware streaming engine, Flow-X.

Our holistic strategies enable fintech companies, banking institutions, and insurance providers to proactively detect and prevent financial fraud stemming from synthetic identities, first-party fraud and abuse, as well as intentional and unintentional (friendly) fraud.

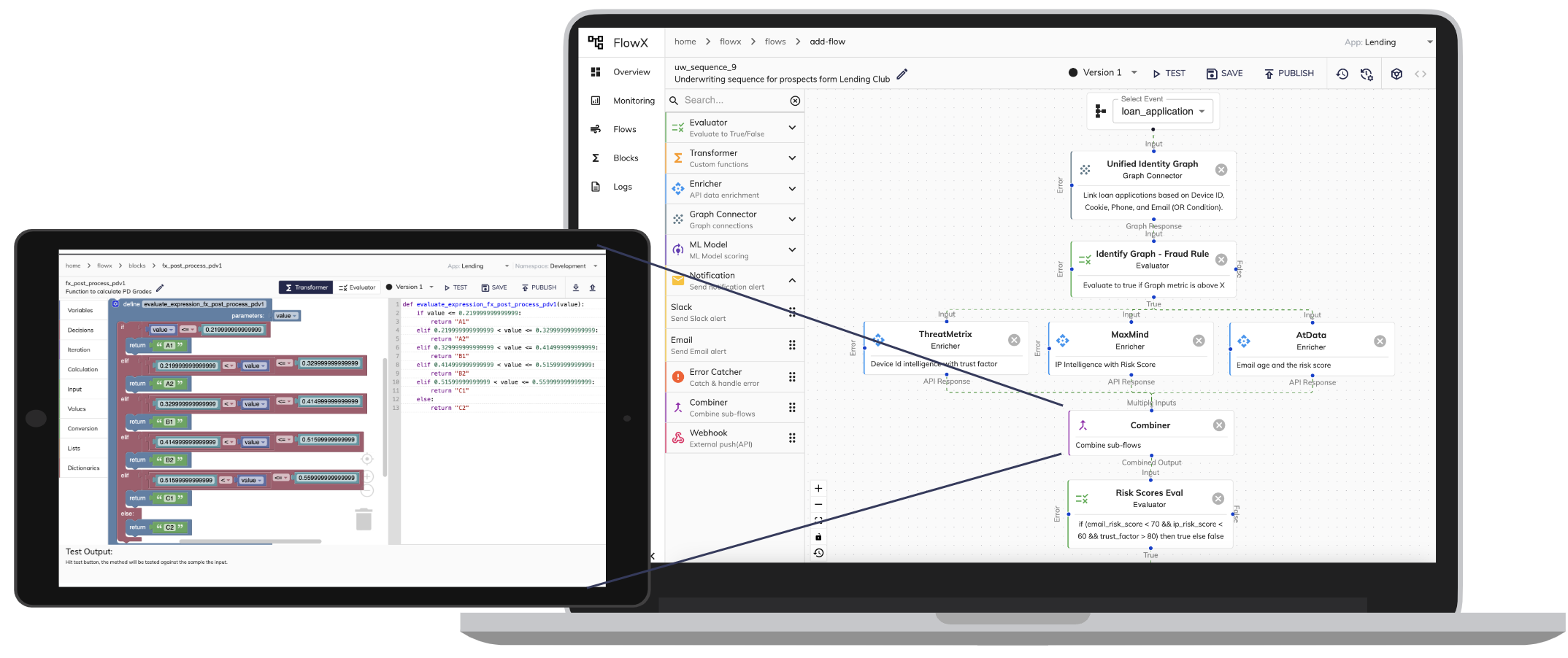

Flow-X: Uncovering the Invisible Hand

Flow-X technology is adept at identifying patterns indicative of high-risk and triggering systematic fraud alerts efficiently. This capability has proven essential in uncovering complex fraud schemes orchestrated by criminals exploiting individuals under financial strain, a phenomenon we describe as "The Invisible Hand."

These intricate patterns evade simple detection methods, but through our strategic application of AI/ML techniques analyzing digital footprints and aggregated data, we are uniquely positioned to expose and counteract sophisticated fraud schemes.

Key Features of Flow-X:

- Memory-Aware Streaming Engine: Real-time analysis of transaction data to identify emerging fraud patterns.

- Patented Technology: Our proprietary approach offers a dynamic, ongoing assessment of fraud risks, akin to an antivirus system for financial transactions.

- Holistic Analysis: Combines machine learning, graph analytics, and entity-based profiling to detect hidden fraud networks.

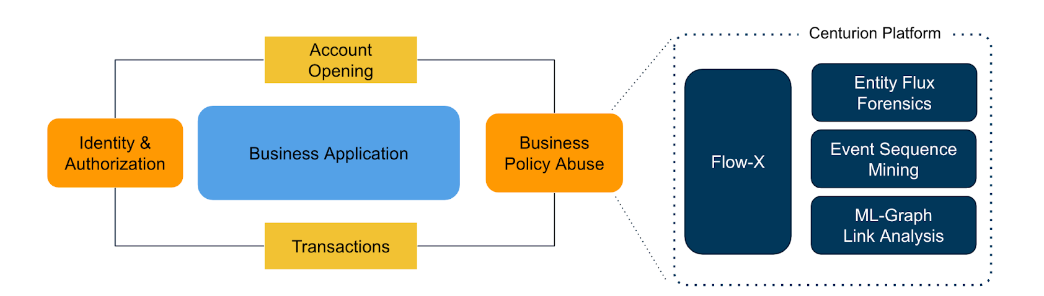

Hudson Data's Three-Pronged Tactical Strategy

Hudson Data’s three-pronged tactical strategy for financial fraud detection ensures a comprehensive approach to neutralizing threats while maintaining a positive customer experience.

1. Entity Flux Forensics

Entity Flux Forensics represents a multifaceted approach to fraud detection that analyzes profile changes and interactions across accounts to identify repeated fraudulent activity. This method recognizes that fraudsters often exhibit patterns detectable through profile changes or interactions across multiple accounts.

Key Elements:

- Profile Change Monitoring: Detects changes in customer behavior indicative of fraud.

- Cross-Account Interaction Analysis: Identifies suspicious activities across multiple accounts.

- Preventive Measures: Enables financial institutions to proactively mitigate risks.

2. Event Sequence Mining

Using specialized AI deep learning architectures that adapt to different payment frequencies and types, Event Sequence Mining analyzes temporal event sequences within financial transactions. By examining the timing and frequency of transactions, the system discerns irregularities signaling fraudulent activity, even when fraudsters attempt to conceal their actions.

Key Elements:

- Temporal Sequence Analysis: Evaluates the timing and frequency of financial transactions.

- Behavioral Pattern Detection: Identifies deviations from established norms.

- Adaptive AI Models: Tailored to detect various payment types and frequencies.

3. Linkage and Graph Analytics

Utilizing our ML-Graph product, we link transactions and actors in real time to uncover fraud networks and complex schemes such as synthetic ID fraud and insurance fraud. The system updates the graph and looks up entities within nanoseconds, enabling real-time link analysis.

Key Elements:

- Graph-Based Link Analysis: Connects entities to reveal hidden fraud networks.

- Synthetic ID Fraud Detection: Identifies synthetic identities within transaction data.

- Nanosecond Response Time: Provides real-time insights for rapid decision-making.

Maintaining Customer Trust

While implementing robust fraud detection strategies, maintaining a positive customer experience is paramount. We minimize false positives to prevent unnecessary inconvenience to genuine customers, thereby preserving customer trust and satisfaction. This approach reflects industry best practices and underscores our commitment to safeguarding financial transactions while maintaining customer loyalty.

Conclusion

The Centurion SaaS Platform, powered by our patented Flow-X technology, distinguishes itself through its comprehensive approach to detecting and preventing financial fraud. Our Entity Flux Forensics, Event Sequence Mining, and Linkage and Graph Analytics strategies ensure that fintech companies, banking institutions, and insurance providers remain at the forefront of financial security.

By combining cutting-edge technology with best-in-class fraud detection practices, Hudson Data offers unparalleled protection against the increasingly sophisticated threats posed by financial fraud and abuse.